Last Updated on januari 28, 2026 by Ideal Editor

Turkey’s Economic Revival Gains Momentum: Recognition at the World Economic Forum (WEF) Davos 2026

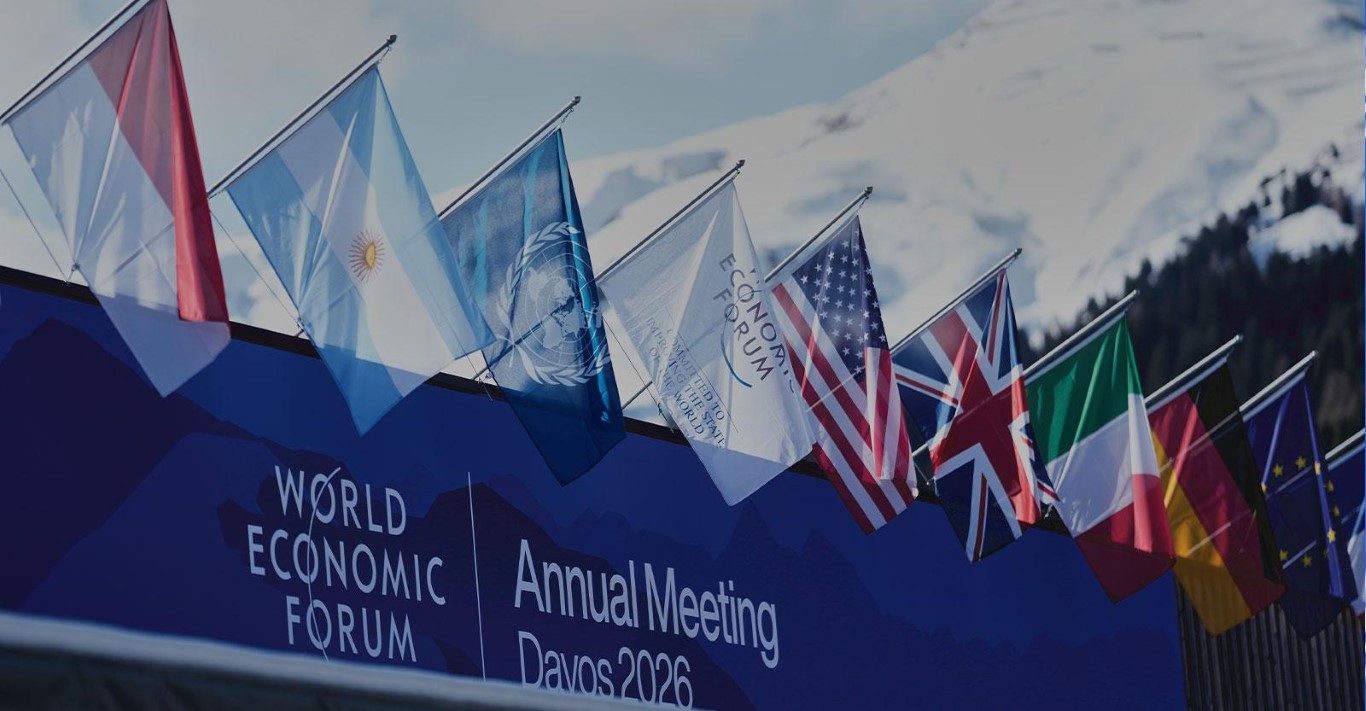

Turkey’s Economic Revival Gains Momentum and is once again attracting global attention—this time for the right reasons. At the World Economic Forum (WEF) Annual Meeting in Davos, senior leadership from one of the world’s largest financial institutions delivered a powerful endorsement of Turkey’s current economic strategy.

Christian Keller, Head of Global Economic Research at Barclays, described Turkey as one of the most capable economies globally when it comes to managing uncertainty, highlighting falling inflation, rising foreign capital inflows, strengthening central bank reserves, and renewed investor confidence.

For real estate investors, developers, and international buyers, this marks a pivotal moment.

Economic stability, credible monetary policy, and geopolitical positioning are aligning to create a potentially transformative investment climate—especially within Turkey’s property market.

This in-depth analysis explores what these developments mean, how they impact real estate, and why Turkey is increasingly viewed as a strategic destination for long-term capital.

🌍 Global Recognition at Davos

The World Economic Forum is where international capital forms its outlook.

When senior figures from global banks speak positively about a country’s economic direction, markets listen.

Key messages delivered in Davos included:

- 💰 Capital inflows into Turkey are increasing

- 🏦 Central Bank reserves are accumulating

- 📉 Inflation is on a clear downward path

- 📊 Economic competitiveness remains intact

- 🔒 Policy credibility is being restored

These are not abstract macroeconomic achievements—they directly influence currency stability, financing conditions, mortgage markets, and investor sentiment across the property sector.

📈 Turkey’s Inflation Strategy Explained

A Disciplined Monetary Framework

Turkey’s recent economic recalibration has centered on predictability and transparency.

According to Keller, the Central Bank of the Republic of Turkey (CBRT):

- Adjusts interest rates only when inflation trends justify it

- Maintains positive real interest rates

- Avoids reactive or politically driven interventions

- Signals policy decisions clearly to markets

This disciplined approach has dramatically improved credibility.

Why This Matters to Investors

Stable inflation expectations are essential for:

- Long-term property valuations

- Mortgage affordability

- Rental yield predictability

- Foreign currency risk management

When inflation declines gradually and policy remains consistent, investors gain confidence to commit capital for longer horizons.

📊 Inflation Trend Overview

| Year | Inflation Direction | Investor Impact |

|---|---|---|

| 2023 | Extremely volatile | High uncertainty |

| 2024 | Stabilisation phase | Cautious optimism |

| 2025 | Declining trend | Renewed investment |

| 2026 (forecast) | Moderate levels | Sustainable growth |

📉 Lower inflation = higher real returns, especially in real estate where income streams are long-term.

💵 Foreign Capital Is Returning

One of the strongest signals highlighted at Davos was the renewed inflow of international capital.

Drivers behind this trend include:

- ✔ Predictable monetary policy

- ✔ Strengthened central bank credibility

- ✔ Competitive asset pricing

- ✔ Strong tourism and population growth

- ✔ Strategic geographic position

Foreign investors are once again allocating capital to:

- Turkish bonds

- Equity markets

- Infrastructure

- Residential and commercial real estate

🏗️ Upward Surprise in Economic Growth

Keller described Turkey’s economic outlook as an “upward surprise.”

Despite tight monetary conditions:

- Domestic consumption remains resilient

- Manufacturing exports continue

- Tourism revenues are strong

- Employment stability supports housing demand

This combination is rare.

Many economies face recessionary pressures when inflation control is implemented. Turkey, however, has managed to cool inflation without stalling growth.

🏘️ What This Means for Real Estate

Structural Demand Remains Strong

Turkey’s housing market benefits from long-term fundamentals:

- 👥 Population exceeding 85 million

- 🏙️ Rapid urbanisation

- 🧳 Record tourism numbers

- 🏡 Limited new housing supply in prime cities

- 🌍 Rising international buyer interest

Even during economic tightening, housing demand has not collapsed—a critical indicator of structural strength.

Property Market Implications

| Factor | Impact on Property |

|---|---|

| Falling inflation | Price stability |

| Capital inflows | Liquidity growth |

| Reserve accumulation | Currency confidence |

| Economic growth | Buyer affordability |

| Global diversification | Foreign demand |

These conditions support:

- Capital appreciation

- Strong rental yields

- Increased off-plan confidence

- Long-term portfolio diversification

🌐 Geopolitical Advantage: Turkey’s Strategic Position

While global uncertainty is rising, Turkey occupies a unique position.

Key advantages include:

- Not at the center of major trade conflicts

- Strong ties with Europe, Middle East, and Asia

- Flexible diplomatic positioning

- Major logistics and energy corridor

Christian Keller noted that Turkey has historically been one of the best economies at managing uncertainty—a critical advantage during volatile global cycles.

🧭 The Trump Factor and Global Volatility

Global markets are currently navigating:

- Renewed US tariff threats

- Rising geopolitical tensions

- Trade friction between the US and Europe

- Uncertainty surrounding global supply chains

While these issues pressure Europe and Asia, Turkey’s diversified economic relationships allow it to:

- Absorb shocks more effectively

- Attract redirected investment flows

- Benefit from regional supply chain shifts

If Europe increases internal investment and reforms—as suggested in Davos—Turkey stands to benefit directly due to its deep trade integration.

🏘️ Real Estate Investors Are Watching Closely

As macroeconomic stability improves, real estate typically follows in stages:

- Currency stabilisation

- Inflation moderation

- Capital inflows

- Improved financing conditions

- Property price growth

Turkey is currently transitioning between Stages 2 and 3—historically the most attractive entry point for investors.

📊 Real Estate Opportunity Timeline

| Phase | Market Behaviour | Investor Opportunity |

|---|---|---|

| Crisis | High volatility | High risk |

| Stabilisation | Price consolidation | Strategic entry |

| Recovery | Rising demand | Capital gains |

| Expansion | Strong appreciation | Lower yields |

Current conditions strongly resemble the stabilisation-to-recovery phase.

🧠 Investor Takeaways

🔹 Global financial institutions are regaining confidence

🔹 Inflation is declining under a credible policy framework

🔹 Central bank reserves are strengthening

🔹 Economic growth remains resilient

🔹 Property fundamentals remain intact

🔹 Foreign investor activity is rising

Together, these factors support a medium-to-long-term positive outlook for Turkish real estate.

🏢 How Ideal Estates Can Help

Navigating property investment during economic transition requires expert guidance.

Ideal Estates supports clients by:

- 📍 Identifying high-growth neighbourhoods

- 📊 Analysing market timing and price cycles

- 🏘️ Accessing vetted residential and commercial projects

- 💼 Advising international investors on regulations

- 💱 Supporting currency and payment structuring

- 📝 Managing legal, title deed, and transaction processes

Our role is not simply to sell property—but to help clients make informed, data-driven investment decisions aligned with evolving economic conditions.

⭐ Why Partner With Ideal Estates

Market Expertise

Deep understanding of Turkey’s economic cycles, property trends, and regional performance.

Professional Guidance

Clear, transparent advice based on fundamentals—not speculation.

Local Knowledge

On-the-ground insight into pricing, supply dynamics, and future infrastructure zones.

Client-Focused Approach

Tailored solutions aligned with investment goals, budgets, and timelines.

End-to-End Real Estate Solutions

From property sourcing to legal support, after-sales management, and portfolio expansion.

Ideal Estates acts as a long-term advisor, not a transaction-driven intermediary.

❓ Frequently Asked Questions About Turkey’s Economic Revival Gains Momentum

1. Why is Turkey attracting investors again?

Because inflation is falling, monetary policy credibility has improved, reserves are increasing, and asset prices remain competitive.

2. Is now a good time to invest in Turkish real estate?

Many analysts consider the current stabilisation phase one of the strongest long-term entry points.

3. How does inflation affect property investments?

Lower and predictable inflation improves financing conditions, stabilises prices, and increases real returns.

4. Are foreign buyers active in Turkey?

Yes. International demand is rising, particularly in Istanbul, Antalya, and coastal investment regions.

5. How can Ideal Estates support international investors?

Through property selection, legal guidance, transaction management, and long-term portfolio planning.

Turkey’s economic narrative is shifting—from uncertainty to credibility, from volatility to opportunity.

If you want to stay ahead of market trends:

✅ Explore our related property and market insight articles

✅ Contact Ideal Estates for expert guidance

✅ Request a personalised consultation

✅ Subscribe for exclusive investment updates and analysis

Ideal Estates — your trusted partner in navigating Turkey’s evolving real estate landscape.